Donate

MMF is a charity dedicated to the support of Maidstone’s Museums. Our ability to assist them financially is dependent on membership subscriptions and generous donations.

We hope you could support us in this way, as a donation will help to ensure that Maidstone’s important heritage and culture can continue to be enjoyed by everyone now, and for future generations to come.

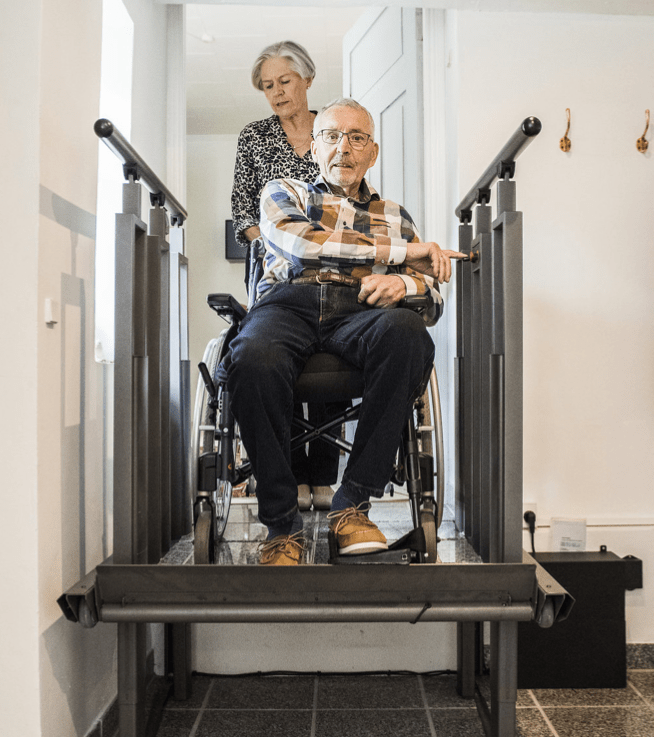

Current Campaign 2024 - Installation of a Flexstep at the Museum

Dear Friend

The Board of MMF has decided to launch a funding campaign to support the Museums‘ continued desire to improve access to and from more parts of the Museums for people with disabilities and those with young families. As you well know, the Museums have many changes of floor levels and this initiative is yet another step to making the building accessible to everyone.

The current project is about the installation of a “Flexstep” at the small flight of steps between the area at the foot of the main staircase on the one hand and the local history gallery, the costume gallery and the forthcoming archaeology gallery ‘Lives in our landscape’ on the other. A “Flexstep” is a small flight of steps that transforms, at the push of a button, into a level platform descending (and ascending) to the other level.

The cost of this device is in the region of £25,000 and the MMF Board has agreed to assist in seeking to raise finance for this. Trustees have already given £3,000 from reserves. We know that the actual work has been completed, ensuring it is in place for the opening of the new gallery in June – but we know the Museums would be very grateful for financial assistance.

We are asking if you could provide some financial contribution to this worthy cause. There are three ways you could do this:-

1. use our website and donate online at www.maidstonemuseumsfriends.org.uk On this ‘Donate’ page there is a button to donate at the end of this text – go to ‘Flexstep Fund Donation‘ in the drop down menu in the ‘Use this donation for’ box.

You can pay by credit or debit card using our secure Paypal payment gateway below.

2. give cash or a cheque to Maidstone Museums’ reception – clearly marked for MMF’s attention, to ensure it goes to the right cause.

You can do this in person or by post to:

Maidstone Museum

St Faith’s Street

Maidstone

ME14 1LH

3. give cash or a cheque in person by visiting the Friends’ shop on Thursdays or Fridays, 10am to 3pm.

Fremlin Walk

Maidstone

ME14 1PS

Gift Aid: Please consider Gift Aiding your donation. It won’t cost you a penny more, but is worth 25% extra to MMF and this campaign.

A declaration form available to download here for printing, completion and return if you wish to pay by cash or cheque. There are clear instructions on this page of the website if you are giving online.

We do very much hope you will feel able to get involved in this worthy campaign.

THANK YOU

2022 Campaign - LIVES IN OUR LANDSCAPE

The Museum has embarked on an ambitious plan to totally renovate the current Archaeology Gallery – to be called “Lives in Our Landscape”.

On display will be objects from a great span of time – from 400,000 to 500 years ago – telling a coherent story about the time

and place where they originated and, most importantly, about the people who made and used them. If you wish to see a fuller

description please see the ‘projects’ page

It is an exciting proposal to enliven everyone’s appreciation and understanding of our past.

MMF is fully supportive of this initiative and set itself a target of raising £100,000 towards the total cost of £600,000.

To start the ball rolling the MMF Board contributed £5,000 from our reserves, and submitted applications for funding to other local charities and appeals to friends.

We are delighted to report that on 24th December 2022 the Foundation reached its campaign target of £100,000.

A big thank you to everyone who donated towards this project.

You can donate to the ‘General Support Fund’ now using our PayPal payment gateway – please click our logo below or if you’re viewing this on a desktop scan the QR Code to donate using your with your mobile device.

After clicking the MMF logo you will be taken directly to the secure Paypal Payment Gateway where you can pay using a Credit/Debit card or a PayPal Account, entering your details as requested.

Once the payment process is completed you will be returned to the MMF website.

Please support our work by donating

Please notify the charity if you:

- want to cancel this declaration

- change your name or home address

- no longer pay sufficient tax on your income and/or capital gains

Legacies & Wills

Have you the will to help?

Leaving support in your Will is an excellent way to assist the Museums. In every instance of wishing to leave finance in your Will to MMF you should speak to your solicitor. Once you have decided you want to leave a legacy you need to decide how you wish to leave your gift. There are several options:

Residuary Bequest

Leaving a share of what you own. This means you leave a percentage of your Estate after provision for your loved ones and after all your other gifts and debts have been paid. It has the advantage that the value will not be eroded by inflation over the years.

Pecuniary Bequest

Leaving a fixed sum of money. You decide on a specific sum of money that you would like to leave to MMF. The value of pecuniary legacies will decrease in time as the cost of living increases.

Specific Bequest

Leaving a property, an item of value or shares. You may have a valuable item in mind that you would like to give. It is important that you know that we might not be able to keep that item or any shares without prior agreement. We will need either your consent or the consent of your Executors to sell any items you leave to us, and use the money raised for our work in supporting the Museums

Contingent Bequest

A gift in your Will that depends on the occurrence of an event, which may not happen, is known legally as a contingent bequest. An example is a bequest to a charity which applies only if other beneficiaries named in the Will die before the testator (person who made the will).

Where there’s a Will there’s a way

Should you wish to remember Maidstone Museums’ Friends in your Will, you can do so quite simply by making a Codicil (addition) to your existing Will. There are two types – Residuary Bequest (a proportion) and a Pecuniary Bequest (a net sum).

If you are interested in doing so please contact your solicitor to talk this through.

The Charity trustees are not providing legal advice. It is advisable that proper legal advice is taken in preparing a Will as it is a legal document.